Malaysia Car Duty Calculator

Malaysia Import Duty Calculator. 16 of Customs Value Import Duty Excise Duty IDF.

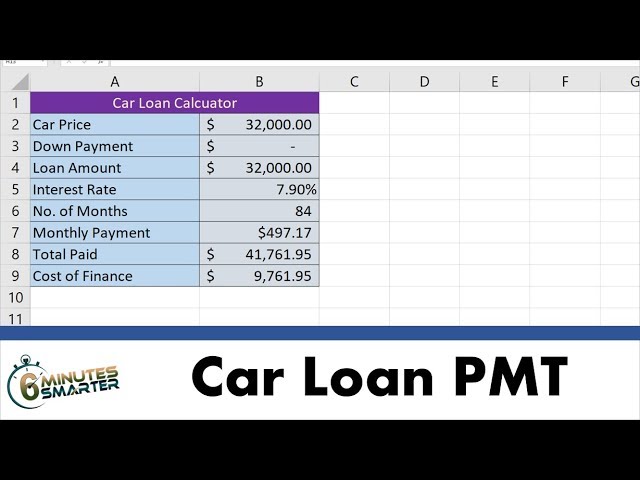

Auto Loan Calculator Free Auto Loan Payment Calculator For Excel

ENGINE CAPACITY CYLINDER CAPACITY CC.

. Excise duty is between 60 and 105 regardless of CKD or CBU calculated based on the car and its engine capacity while import duty can reach up to 30 depending on the vehicles country of. For details about import duties and local taxes from the Malaysian Automotive Association. How to calculate your road tax amount.

These taxes cause a foreign car to cost almost three times or 200 more than the original price. Below is a table showing different rates of applicable duty on these motor vehicles. Sales Tax Imports are subject to GST at a standard rate of 6 of the sum of the CIF value duty and any excise if applicable.

Total duty payable K500 000 K750 000 K536 250 K1 786 250. Import duty must be paid on any vehicles imported into Malaysia. Additional costs that might not come up on your duty calculations.

Some goods may be zero-rated or exempt from GST. Import excise 30100 x 2 000 000 500 000K750 000. Duty rates for saloons station wagons and Sport Utility Vehicles SUV are based on engine size or cylinder capacity of the vehicle and the year of make.

Kenya KRA Car Duty Calculator. Enter loan interest rate in Percentage. Calculation of duty for saloons.

These excise duties imposed on foreign manufactured cars have made them very expensive for consumers in Malaysia. Enter car loan period in Years. These taxes are also one of the highest in the world.

It then gives you the Import Duty Excise Duty VAT IDF Fee RDL. Please complete information below. 25 of the Customs value CIF of the vehicle ie.

Fortunately vehicles from ASEAN countries are not imposed with import duty. MRA further wishes to remind all motor vehicle importers that declaring a false year of make for a vehicle is an offence that attracts high penalties. Based on the Private Cars in.

Things To Know When Shipping To Malaysia. When shipping a package internationally from United States your shipment may be subject to a custom duty and import tax. Some Stamp duty is paid fully by buyer and some are shared between buyer and seller and some are.

Cars with more than 1000cc will pay 50 less of the road tax price in West Malaysia. Enter down payment amount in Malaysian Ringgit. Share our website to your.

In property buysell there is a Stamp Duty on MOT is the stamp duty we need to pay for Memorandum of Transfer MOT. Import duty 10 Excise duty 5 and VAT 165. Lets go through the private car calculation with the Proton Perdana mentioned at the start.

The calculator will provide the current KRA CRSP value from which it calculates the depreciation to give you the Customs Value. All of our calculators are completely free to use with no registration required. Every country is different and to ship to Malaysia you need to be aware of the following.

SST Calculator Sales and service tax. 5 Free Calculations Per Day At Simply Duty you get to use our duty calculator free of charge. On the other hand import duty can reach up to 30 depending on the vehicles country of manufacture.

Tax calculator needs two values. These rates can be quite high and excise duties can be up to 100 percent when importing a foreign vehicle. Do not fill in the currency.

Our goal is to become one-stop Malaysia Online Calculator website for Malaysian users who need to make quick calculations. However calculation of duty on motor vehicles with GVW not exceeding 10 tonnes does not depend on the year of make but only on GVW. In Malaysia when you heard people saying Stamp Duty Calculator it refers to Stamp Duty on MOT Calculator also commonly known as Stamp Duty Calculator.

2 of the CIF value. Price before tax and price are. Find out if you can afford your dream car using our user friendly car loan calculator.

Use this quick tool to calculate import duty taxes for hundreds of destinations worldwide. Import VAT 165100 x 2 500 000 750000 536 250. Exporting from which country.

Laptops electric guitars and other electronic products. Some goods are not subject to duty eg. On top of sales tax depending on the car and its engine capacity excise duty is levied between 60 and 105.

The duty rates for pick-ups lorries and trucks are as follows. Calculation of duty for saloons. Direct import concept solution D concept car import tax malaysia car import agent Malaysia car import rules and regulations car import duty import car from australia to Malaysia malaysia car import tax calculator how to import a car shipping car to malaysia recond car AP car car from japan car from uk car from australia vehicle import duty importing a vehicle can i import a car.

Duty Rates Duty rates in Malaysia vary from 0 to 50 with an average duty rate of 574. Price without tax. Car Insurance Calculator Calculate how much you will have to spend on your car insurance.

Pick-ups and trucks of less than 5 tonnes GVW and 5 to 10 tonnes GVW. 25 of Invoice value Insurance Freight charges Excise duty. Enter car price in Malaysian Ringgit.

Fill in tax and price - and get price before tax as result. 20 of Customs Value Import Duty VAT. To calculate the approximate costs of road tax.

This makes most foreign cars extremely expensive for buyers although cheaper in other countries. You need to fill in two fields. Afghanistan Albania Algeria American Samoa Andorra Angola Anguilla Antarctica Antigua and Barbuda Argentina Armenia Aruba Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia.

Select the car make model trim fuel and age from the boxes below for the current Kenya Revenue Authority KRA import duty evaluation. When looking at the specifications of the car we can see that the 24L version has 2354cc engine.

Car Tax Calculator Calculate Your Car Taxes Car Insurance Cheap Car Insurance Inexpensive Car Insurance

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

Tasc Car Deloitte Company Car Calculator Deloitte Belgium Tax

Use The Pmt Function To Calculate Car Loan Payments And Cost Of Financing Youtube

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Luxury Tax To Encourage People To Buy More Fuel Efficient Cars Ttautoguide Com

0 Response to "Malaysia Car Duty Calculator"

Post a Comment